Key Findings

- Taxpayers reported almost $12.1 trillion of whole earnings on their 2019 tax returns.

- About 68 p.c ($8.3 trillion) of the entire earnings reported on Form 1040 consisted of wages and salaries, and 82 p.c of all tax filers reported incomes wage earnings.

- Retirement accounts equivalent to 401(ok)s and pensions are necessary sources of capital earnings for the center class. Taxable IRA (Individual Retirement Account) distributions, pensions, and annuities (greater than $1.1 trillion) and taxable Social Security advantages ($360 billion) accounted for about $1.47 trillion of earnings in 2018.

- Business earnings is one other massive element of reported private earnings. Businesses that report earnings taxes by means of the person earnings tax system, like S companies, sole proprietorships, and partnerships, accounted for $1.1 trillion of earnings in 2018.

- Investment earnings consisting of internet capital good points, taxable curiosity, and bizarre dividends accounted for almost $1.2 trillion of earnings in 2018, greater than enterprise earnings and barely lower than taxable retirement earnings.

Introduction

The particular person earnings tax is the federal authorities’s largest income. More than 157 million particular person earnings tax returns had been filed for tax 12 months 2019, the second 12 months underneath the modifications made by the Tax Cuts and Jobs Act (TCJA).

Each family with taxable earnings should file a return to the Internal Revenue Service (IRS). On the IRS particular person earnings tax type (Form 1040), all sources of taxable earnings are listed on the primary web page and added to achieve whole earnings. From there, the taxpayer’s deductions and credit are calculated on the tax return to find out tax legal responsibility and tax owed or refunded.

This report will give attention to sources of reported whole earnings in 2019, which amounted to greater than $12.1 trillion.[1] We will evaluation the element components of whole earnings reported on strains 1 by means of 5 of the 2019 Form 1040 and on the 2019 Schedule 1.[2] Reviewing reported earnings helps to grasp the composition of the federal authorities’s income base and the way Americans earn their taxable earnings.[3] We divide earnings into 4 main classes—wages and salaries, enterprise earnings, funding earnings, and retirement earnings—and evaluation every class for tax 12 months 2019.

| Income Type | Amount |

|---|---|

| Salaries and Wages | $8,273 |

| Capital Gains Less Losses | $879 |

| Pensions and Annuities | $784 |

| Partnership and S Corporation Net Income (Less Losses) | $677 |

| Business or Profession Net Income (Less Losses) | $443 |

| Taxable Social Security Benefits | $360 |

| Ordinary Dividends* | $332 |

| Taxable Individual Retirement Arrangement (IRA) distributions | $325 |

| Taxable Interest** | $153 |

| Total Rent and Royalty Net Income (Less Losses) | $63 |

| Other Income Less Loss | $38 |

|

* The IRS excludes certified dividends from whole earnings, which quantities to about $248 billion. ** Tax-free curiosity, equivalent to curiosity on municipal bonds, provides one other $62 billion. Source: IRS SOI Table 1.3. |

|

Wages and Salaries Make Up $8.3 Trillion of Personal Income

Wages and salaries comprise the most important general supply of whole earnings. For most tax filers within the U.S., the most important earnings quantity on their very own Form 1040 seems on the road the place they report wages, salaries, tips, and different compensation for his or her work. In different phrases, most Americans report incomes labor earnings, and most of their earnings comes from labor as a lot of the American economic system is made up of labor compensation. In whole, greater than 129 million tax filers in 2019 reported $8.3 trillion in wage earnings, making up 68 p.c of whole earnings.

The quantities reported on Form 1040 replicate most, however not all, labor compensation. For instance, companies additionally pay for worker well being advantages and contribute to Social Security, each of that are excluded from earnings taxation.

Wage and wage earnings is taxed at a progressive charge schedule with charges starting from 10 p.c to 37 p.c. The high charge of 37 p.c was levied on taxable earnings above $510,000 for single filers and above $612,350 for married {couples} submitting collectively in tax 12 months 2019.[4]

Business Income Makes Up $1.1 Trillion of Personal Income

In the United States, pass-through entities are the dominant tax submitting construction for companies, so labeled as a result of the earnings is just not taxed on the enterprise stage however as a substitute instantly “passed through” to particular person homeowners’ tax returns utilizing schedules C, E, and F. According to the U.S. Census Bureau, in 2019, 91.1 p.c of companies used the pass-through construction, and the bulk had been sole proprietorships, absolutely owned by a single particular person.[5]

Pass-through corporations make use of a lot of the private-sector workforce within the U.S., and account for many enterprise earnings.[6] Partnerships and S companies reported $677 billion of internet earnings in 2019. Individuals reported an extra $443 billion of enterprise or skilled earnings (sole proprietorship earnings). Together, enterprise earnings much less losses totaled about $1.1 trillion when together with earnings from estates, farms, trusts, rents, and royalties.[7]

Unlike companies topic to the company earnings tax, pass-through enterprise earnings is taxed as bizarre earnings on homeowners’ private tax returns. Like salaries and wages, pass-through enterprise earnings is taxed on the similar progressive charge schedule. The TCJA established a brief 20 p.c tax deduction for pass-through enterprise earnings, however sure limits and {qualifications}.[8]

Investment Income Makes Up Nearly $1.4 Trillion of Personal Income

Overall taxable funding earnings amounted to roughly $1.4 trillion in 2019, consisting of taxable curiosity, dividends, and capital good points earnings. Taxpayers reported $331 billion of taxable bizarre dividends and $879 billion of internet capital good points and capital achieve distributions, solely a few of which comes from the sale of company inventory.[9] Taxable curiosity accounted for about $153 billion, and taxpayers reported $19.4 billion of internet good points from gross sales of property aside from capital belongings, equivalent to sure actual enterprise property or copyrights.

Taxable labor compensation is far bigger than taxable funding earnings. While the returns to company inventory and different capital belongings discovered on particular person earnings tax returns are substantial, they’re small in comparison with the quantity of labor earnings taxpayers earned, which totaled $8.3 trillion in tax 12 months 2019.

Some funding earnings is topic to bizarre earnings tax charges and a few is topic to a separate schedule with decrease tax charges. Taxable curiosity, bizarre dividends, and short-term capital good points (good points realized on belongings held for lower than one 12 months) are taxed as bizarre earnings at a taxpayer’s marginal earnings tax charge, similar to wage and wage earnings. Long-term capital good points (good points realized on belongings held for multiple 12 months) are taxed at decrease charges, starting from 0 p.c to twenty p.c, plus a 3.8 p.c internet funding earnings tax, relying on a taxpayer’s taxable earnings.[10]

Retirement Income Makes Up Nearly $1.5 Trillion of Personal Income

In 2019, taxpayers reported about $784 billion of pensions and annuities and $325 billion of taxable IRA distributions.[11] In addition to personal saving, taxpayers reported about $360 billion in taxable Social Security advantages in tax 12 months 2019, for a complete of $1.5 trillion in taxable retirement earnings.

Taxpayers reported barely extra taxable funding earnings from retirement accounts than from outdoors of retirement accounts. America’s system of retirement accounts, whereas overly complicated, is taxed neutrally, eradicating the tax bias in opposition to saving.[12]

It is usually arduous to trace capital earnings in retirement accounts, particularly as a result of it doesn’t seem on IRS varieties till it’s distributed. Economists typically wrestle with categorizing retirement earnings appropriately. The Congressional Budget Office (CBO) launched a report in 2011 on developments within the distribution of earnings which reviewed the portion of capital earnings in retirement accounts.[13]

The report accounted for all of the sources of earnings, together with some nontaxable sources. The authors categorized incomes by supply, sorting pensions right into a separate class from labor earnings and capital earnings. Pensions are, partly, compensation for labor. Workers additionally earn capital earnings by deferring their labor earnings and having that earnings invested, typically amounting to multiples of their authentic contributions. While it’s troublesome to allocate pension earnings exactly between labor and capital, staff earn capital earnings by means of their pensions. The CBO report sorted retirement earnings right into a class referred to as “other.”

The CBO report reveals that whereas it’s true that middle-class Americans don’t report a lot funding earnings equivalent to dividends or capital good points on their tax returns, they nonetheless earn returns to capital by means of their retirement accounts, the place saving receives correct tax remedy.

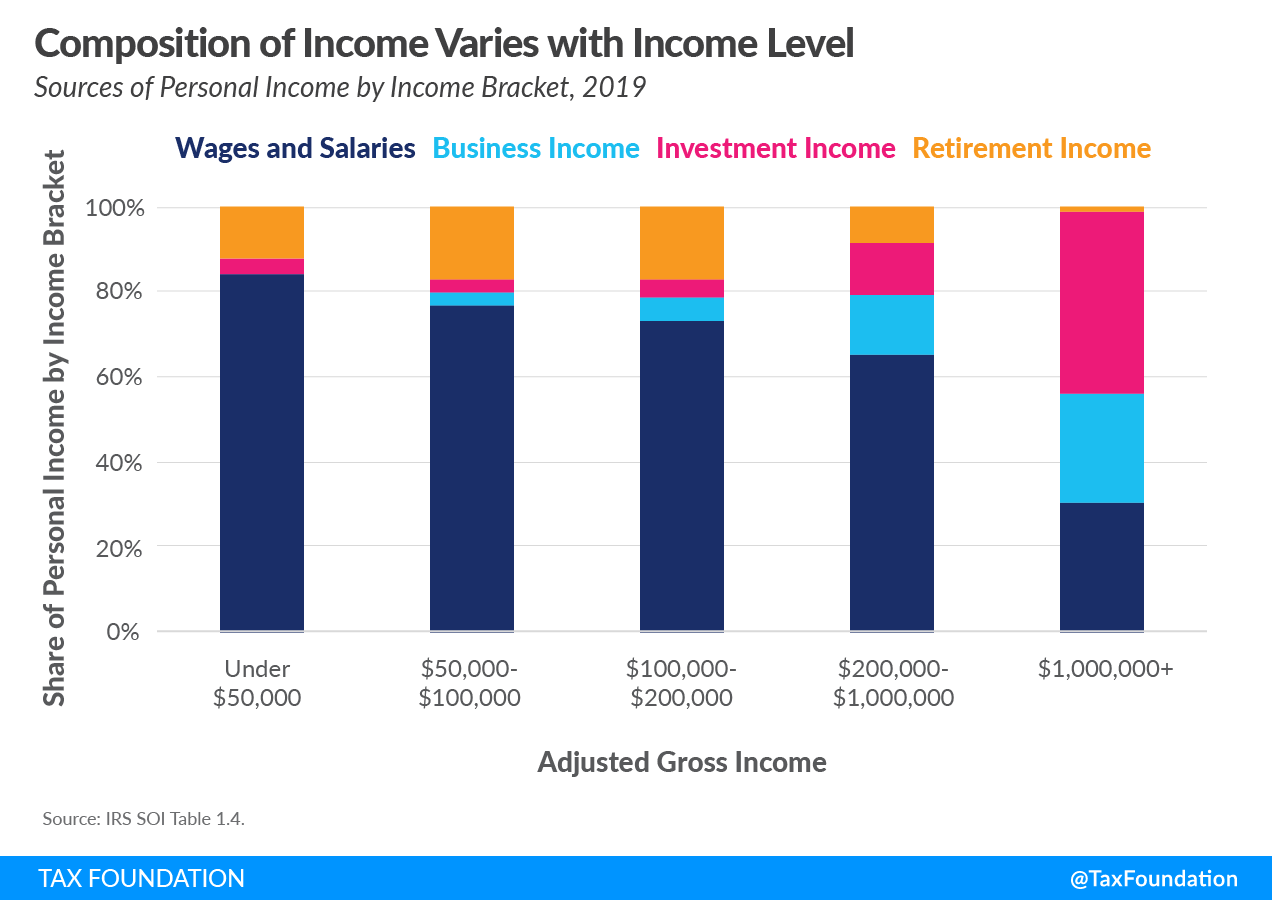

Reviewing the sources of non-public earnings by earnings bracket reveals the significance of retirement earnings to the center class (Figure 2). Retirement earnings is most necessary as a supply of non-public earnings for taxpayers reporting between $50,000 and $100,000 of earnings, making up greater than 17 p.c of the group’s whole earnings. In observe, in fact, a minority of middle-class taxpayers—the retirees—depend on this earnings, whereas the vast majority of working-age taxpayers don’t.

Retirement earnings is troublesome to account for, and the tax guidelines governing retirement accounts usually are not apparent to folks unfamiliar with tax information. Pension and different retirement earnings is, in financial phrases, partially capital earnings and it’s most necessary to middle-class staff, given their accessibility of retirement choices. It is necessary to think about tax reforms that may develop the accessibility of retirement and financial savings accounts which can be impartial with respect to saving and consumption.[14]

Many retirement accounts supply tax-deferred or tax-exempt standing to reduce preliminary tax burden and maximize future earnings. Distributions from tax-deferred IRAs and withdrawals from pension and annuity accounts are taxed as typical earnings and face a progressive charge schedule with charges starting from 10 p.c to 37 p.c. A portion of Social Security advantages could also be taxable at bizarre earnings tax charges, relying on a taxpayer’s whole quantity of earnings and advantages for the tax 12 months.[15]

Conclusion

Reviewing the sources of non-public earnings reveals that the non-public earnings tax is basically a tax on labor, primarily as a result of our private earnings is generally derived from labor. Varied sources of capital earnings additionally play a task in American incomes. While capital earnings sources are small in comparison with labor earnings, they’re nonetheless important and should be accounted for, each by policymakers attempting to gather income effectively and by folks trying to grasp the distribution of non-public earnings.

[1] IRS, “SOI Tax Stats,” Table 1.3.

[2] The Form 1040 modified starting for Tax Year 2018, reflecting modifications from the TCJA. For extra info, see IRS, “Questions and Answers about the 2018 Form 1040,” https://www.irs.gov/forms-pubs/questions-and-answers-about-the-2018-form-1040.

[3] Using information from Form 1040 to grasp the character of earnings within the U.S. economic system comes with some limitations. Not all financial exercise is discovered on private earnings tax varieties—for instance, employer-provided medical insurance and returns to owner-occupied housing are excluded. Both are substantial parts of financial output that don’t seem on earnings tax returns. As broad financial aggregates, although, the classes of earnings established on Form 1040 are nonetheless helpful and instructive.

[4] Amir El-Sibaie, “2019 Tax Brackets,” Tax Foundation, Nov. 28, 2018,

https://www.taxfoundation.org/2019-tax-brackets/.

[5] U.S. Census Bureau, “County Business Patterns (CBP),” https://census.gov/programs-surveys/cbp.html, and U.S. Census Bureau, “Nonemployer Statistics (NES),” https://census.gov/programs-surveys/nonemployer-statistics.html.

[6] Scott Greenberg, “Pass-Through Businesses: Data and Policy,” Tax Foundation, Jan. 17, 2017, https://www.taxfoundation.org/pass-through-businesses-data-and-policy.

[7] IRS, “SOI Tax Stats,” Table 1.3.

[8] For extra, see Scott Greenberg, “Reforming the Pass-Through Deduction,” Tax Foundation, June 21, 2018, https://www.taxfoundation.org/reforming-pass-through-deduction-199a/.

[9] IRS, “SOI Tax Stats.”

[10] Qualified dividends are additionally taxed at preferential charges, however the IRS doesn’t embody certified dividends in whole earnings.

[11] IRS, “SOI Tax Stats,” Table 1.3.

[12] See typically, Erica York, “The Complicated Taxation of America’s Retirement Accounts,” Tax Foundation, May 22, 2018, https://taxfoundation.org/retirement-accounts-taxation/.

[13] Congressional Budget Office, “Trends in the Distribution of Household Income between 1979 and 2007,” Oct. 25, 2011, http://cbo.gov/sites/default/files/10-25-HouseholdIncome_0.pdf.

[14] See Erica York, “The Complicated Taxation of America’s Retirement Accounts,” and Robert Bellafiore, “The Case for Universal Savings Accounts,” Tax Foundation, Feb. 26, 2019, https://www.taxfoundation.org/case-for-universal-savings-accounts/.

[15] See Internal Revenue Service, “Social Security Income,” https://www.irs.gov/faqs/social-security-income.