This article is an on-site model of our Disrupted Times e-newsletter. Sign up here to get the e-newsletter despatched straight to your inbox thrice every week

Good night,

Shanghai’s retailers welcomed metropolis residents again as we speak after a gruelling two-month lockdown that had confined 25mn individuals to their properties in one of many strictest anti-Covid lockdowns in China for the reason that pandemic started.

Policymakers shall be hoping that the (nonetheless partial) reopening of shops and public transport in China’s largest metropolis and monetary centre may also help deal with the sharp slowdown in growth fuelled by the nation’s zero-Covid technique of mass testing, harsh lockdowns, journey bans and compelled quarantine.

The harm has been widespread, from retail gross sales, which had been down 11 per cent in April, to manufacturing, which shrank for the third month in a row in May, in response to new survey knowledge out this morning. Fresh restrictions introduced as we speak in Hong Kong are a reminder that the virus remains to be removed from executed.

During the pandemic peak durations of 2020 and 2021, Chinese manufacturing benefited from surging demand for computing and home tech. However, as economies reopened the emphasis shifted to companies, denting demand for Chinese exports, which grew simply 3.9 per cent in April, the slowest price since July 2020. Rising inflation, fuelled by Russia’s invasion of Ukraine, makes a repeat of the earlier export-led restoration, supported by home consumption, even much less seemingly. The nation additionally stays mired in a property sector disaster.

As our colleagues at Nikkei Asia report as we speak, large identify producers reminiscent of Apple are beginning to transfer a few of their manufacturing out of China after the strict lockdowns in and round Shanghai dented provide chains.

The nation’s leaders have acknowledged that it’ll wrestle to document optimistic development within the present quarter and probably fall wanting its annual goal of 5.5 per cent because it continues to battle coronavirus outbreaks. President Xi Jinping may even grow to be the primary Chinese chief in virtually 50 years to see development fall behind that of the US.

The slowdown additionally has critical implications past China’s borders. As our wonderful visual representation of the nation’s woes explains, its economic system had been anticipated to proceed to drive about one-fifth of all world GDP development till at the very least 2026.

However, the FT editorial board says the deteriorating outlook may present a possibility for Beijing to not solely rethink features of zero-Covid, but additionally its remedy of international direct traders, a lot of whom are planning to pivot away from the nation.

A concentrate on lowering pink tape and guaranteeing equal remedy with native opponents may assist alleviate a few of the gloom, it provides. “What is good for them is good for China’s own economy.”

Disrupted Times will take a brief vacation break on Friday and return on Monday June 6

Latest information

For up-to-the-minute information updates, go to our dwell weblog

Need to know: the economic system

Eurozone unemployment remained at a document low of 6.8 per cent in April, official knowledge confirmed as we speak, with the relative power of the labour market a key merchandise on the European Central Bank’s agenda when it meets to debate financial coverage subsequent week. The information follows document inflation figures printed yesterday of 8.1 per cent within the 12 months to May. Meanwhile, retail gross sales in Germany, the bloc’s largest economic system, fell by a greater than anticipated 5.4 per cent in April. Unhedged author Robert Armstrong contrasts Europe’s cost-push inflation with demand-pull within the US.

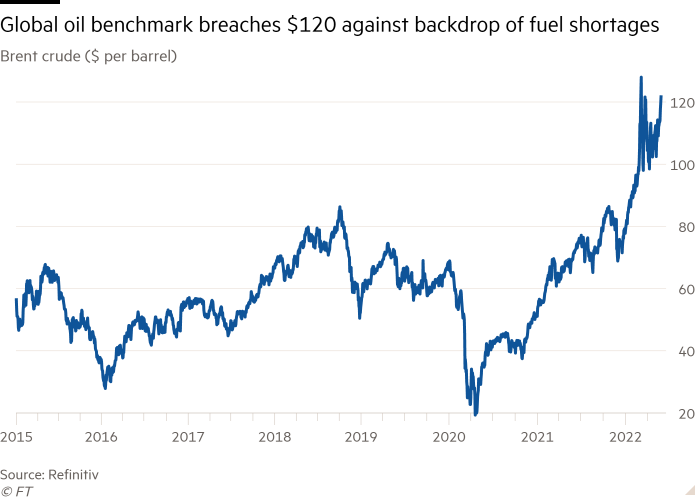

Crude oil costs yesterday breached the $120 mark because of elevated world demand and disruption of provides from Russia. EU leaders agreed to cease most imports, whereas Russian oil cargoes had been additionally hit by an insurance coverage ban. Here’s our explainer on what the measures imply for world markets.

Latest for the UK and Europe

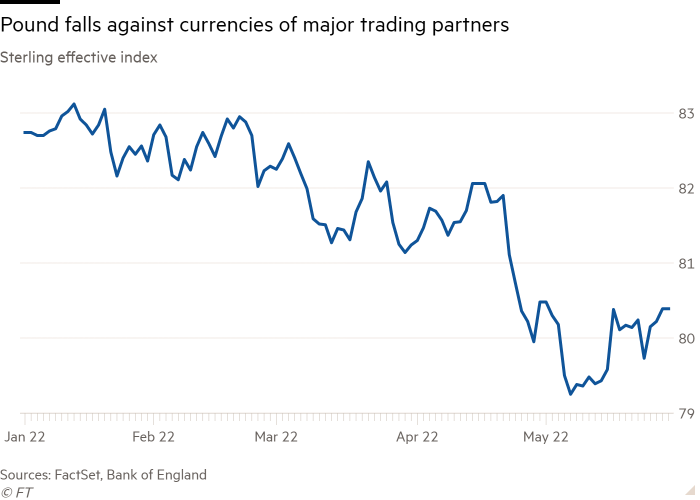

Wall Street banks warned of the “grim outlook” for the pound as excessive inflation and an financial slowdown result in additional declines for the UK forex. Soaring power payments are one of many largest issues for shoppers and our Money Clinic podcast provides some tips for beleaguered households. Even the seemingly unstoppable rise of home costs appears to be cooling just a little.

Disrupted occasions may effectively be the brand new slogan for UK airports. Staff shortages have led to journey chaos, simply because the nation’s busiest week for flying for the reason that begin of the pandemic will get underneath method with the college half-term break and a two-day public vacation for the Queen’s platinum jubilee. A summer time strike can also be looming over pay.

Western sanctions and embargoes are starting to hit Russian shoppers, however buoyant revenues from power exports and interventions from President Vladimir Putin are serving to cushion the affect. Unemployment has remained regular and inflation has begun to gradual.

Global newest

US Treasury secretary Janet Yellen admitted she was “wrong” final 12 months about the specter of rising inflation. US president Joe Biden informed Federal Reserve chief Jay Powell that he would respect the “independence” of the central financial institution because it begins to tighten financial coverage and ramp up rates of interest. Robert Armstrong detects a whiff of optimism in current private consumption knowledge.

International economic system information editor Claire Jones examines the differing approaches to financial coverage among the many world’s central banks and what they imply for traders. And in case you’ve solely bought time to learn one evaluation as we speak, strive Martin Wolf’s newest: Twelve propositions on the state of the world.

Sri Lanka has appealed for meals help from its neighbours as its debt disaster intensifies. Fears round world meals provides have sparked a rush for potash, a vital crop fertiliser that Russia and Belarus provide 40 per cent of. Sanctions are inflicting collateral harm for creating nations which can be unable to purchase grain from Russia.

Global well being professional Nina Schwalbe requires a brand new world compact on vaccines after Covid-19 and now monkeypox have highlighted hoarding by richer nations. Recent efforts to waive mental property guidelines for Covid jabs are an excellent begin, however extra must be executed to unfold manufacturing capability and improvement plus shift the enterprise mannequin from charity to self-reliance, she argues.

Need to know: enterprise

Pfizer will exit Haleon, its joint shopper well being enterprise with GlaxoSmithKline, after its inventory market debut subsequent month within the largest London itemizing for a decade. GSK in the meantime is shopping for Boston-based biotech Affinivax in a $3bn deal to bolster its vaccines enterprise. Takeda, Asia’s largest pharma firm, says the chance of a world recession, the affect of Covid-19 and the struggle in Ukraine may power drugmakers to chop costs.

Small UK companies are struggling to deal with the spiralling prices of power, items and companies, with greater than half reporting elevated enter costs, in response to an official survey. Even low cost retailers are discovering it robust because the financial outlook weakens. B&M’s forecast of decrease income despatched its shares diving 11 per cent yesterday.

A senior government at BlackRock, the world’s largest asset supervisor, informed the Financial Times that the exodus of international expertise from Asia was short-term and that the area remained engaging regardless of political tensions and repeated lockdowns.

Executives are shopping for shares in their very own firms at a speedy price in what some analysts say is an encouraging signal for the US inventory market. “Insiders are saying ‘we don’t see a massive event coming’ . . . [that] these are really good buying opportunities,” says one portfolio supervisor.

Airbus is boosting jet manufacturing in one of many strongest indicators but that the aviation trade is overcoming the turbulence of the pandemic. But whereas there’s clear demand for brand spanking new energy-efficient planes, provide chain issues have sophisticated the manufacturing course of, writes trade correspondent Sylvia Pfeifer.

Brooke Masters, US funding and industries editor, says retailers are more and more mining their enormous buyer bases to cross-sell different firms’ merchandise and earn some helpful fee, whereas their core companies endure from hovering enter costs and provide chain issues.

The World of Work

Diversity, fairness and inclusion methods at the moment are commonplace in main firms, however one factor is commonly lacking: class. Our newest Working It podcast examines why so many working-class individuals really feel alienated and the way firms may also help them thrive and advance.

Covid instances and vaccinations

Total world instances: 524.9mn

Total doses given: 11.8bn

Get the newest worldwide image with our vaccine tracker

And lastly . . .

As Britain enters an extended vacation weekend of celebrations for the Queen’s platinum jubilee, artwork critic Jackie Wullschläger seems at 70 years of royal portraiture and the lengthy historical past of regal picture administration.

Thanks for studying Disrupted Times. If this text has been forwarded to you, please enroll here to obtain future points. And please share your suggestions with us at disruptedtimes@ft.com. Thank you